Have you ever thought about taking out a business loan? Whether you’re just starting out, need to finance large projects or want to refinance existing debt, business loans can provide theRestaurant Furniturery funding you need. Here, we take an in-depth look at what business loans are, how they work and their types.

The Benefits of Taking Out Business Loans

Business loans provide a range of benefits for business owners, from financing a new venture to expanding an existing business. Some of the other benefits of taking out a business loan include:

- Flexible terms – lenders will typically offer longer repayment periods for business loans, allowing borrowers to spread out payments over multiple years.

- Faster time-to-funding – compared to equity investments, banks and other financial institutions tend to offer faster funding turnaround times.

- No loss of control – when you take out a loan, you don’t give up any ownership of your company or control over its operations.

- Cost efficiency – with a business loan, you can apply for a lump sum and use it to cover multiple expenses.

- Potential tax advantages – some business loans may be eligible for certain tax deductions or exemptions, which could help reduce the overall cost of borrowing.

Types of Business Loans

When it comes to business loans, there are many different types to choose from. Here are a few of the most common loans available to businesses today:

- SBA Loan – The Small Business Administration (SBA) provides several loan programs for small businesses that help them access capital quickly and easily. SBA loans come with a variety of guarantees, including reduced interest rates and longer repayment periods.

- Equipment Financing – This type of loan is used to purchase equipment, such as machinery, computers and vehicles, that are essential for business operations. Equipment financing loans are typically short term and the loan amount is based on the expected life of the equipment purchased.

- Invoice Financing – Also known as factoring, invoice financing loans enable businesses to access money based on the value of unpaid customer invoices. With this loan option, the lender will advance a portion of the invoice’s value, usually 80-90%, and then charge a fee for the service.

- Startup Business Loans – As the name implies, these loans are designed specifically for business startups. Startups often face difficulty securing loans due to their lack of credit history and collateral. However, there are several lenders who specialize in providing startup business loans.

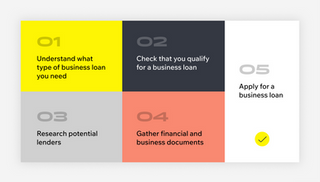

Business Loan Application Process

When applying for a business loan, it’s important to understand the application process. Generally speaking, most lenders will require the following information before making a decision:

- Business Plan – Having a detailed business plan will help lenders understand the goals of your business and determine if the loan is needed for legitimate reasons.

- Financial Statements – Banks and other lenders will typically request several financial statements, including balance sheets, cash flow statements and tax returns, to assess the financial health of your business.

- Business Credit History – Lenders may also check the credit score and other historical data associated with your business to gauge creditworthiness.

- Collateral – As a form of security against default, many lenders will require collateral, such as real estate or assets, as part of the loan agreement.

Tips for Taking Out Business Loans

Taking out a business loan requires thorough research and careful consideration. It’s important to shop around and compare different options to find the best rates and terms available. Additionally, here are a few tips to make sure you get the most out of your business loan:

- Define Your Goals – Before you apply for a loan, take the time to define the goals you hope to achieve with the loan proceeds. This will help you tailor your loan to meet your needs.

- Manage Your Cash Flow – To ensure the success of your business, it’s important to manage your cash flow effectively. Make sure you have enough cash on hand to cover the loan payments and other operational costs.

- Research Different Lenders – Make sure you research different lenders and find one that meets your needs. Compare interest rates, loan terms and other features to find the best deal possible.

- Know Your Credit Score – Before applying for a business loan, check your credit score to see where you stand. If you have a poor credit score, try to improve it before applying for a loan.

In conclusion, taking out a business loan can be beneficial for a range of reasons. With the right lender, you can find the perfect loan that helps fuel the growth of your business. Be sure to carefully consider all of your options and do your research before signing any paperwork.