There is a lot of market noise that makes decision making difficult. The intensity of market noise is inversely proportional to the size of the timeframe. In other words, the longer the time period of the chart, the smoother the price movement looks. On the Trustedbrokerz , price candles look much smoother, and this allows the player to better navigate the market situation.

Thus, it is easier to choose strong levels on large timeframes that you can more or less confidently rely on when making decisions about entering a deal and taking profit. On small timeframes there is a lot of market noise levels are not so well traced.

Trading on small timeframes, scalpers often rely entirely on technical indicators, but this is not a good start for a beginner. An indicator is just an auxiliary tool, which is not without drawbacks. Moreover, they are often late with their values, rendering a disservice to the trader.

Buy on rumors, sell on facts

Rumors can contain both important or even leaked insider information, as well as misinformation, a deliberate lie. Usually, at the time of the appearance of some important hearing on the market, a new, quite powerful and fast wave is generated that can form a strong trend.

There is a stereotype that the principle of buy on the rumors, sell on the facts is guided only by notorious speculators. This is not entirely true: many investors also often use rumors, but in most cases, they identify them with forecasts.

Whether it is a rumor or a forecast, it doesn’t matter to anyone who knows how to analyze market information, filtering out unnecessary. Up-to-date information can benefit a decisive, quick and rationally minded trader.

On the other hand, there are a lot of sources of information on the Internet. Therefore, the cornerstone when working with information is trust in its source. The latter is based on the credibility of the source, its test of time. Not bad if the information is confirmed by at least three similar news from alternative, but trustworthy sources. On the other hand, often the release of news in large publications should be regarded as a signal to exit a position that has already been worked out by the market.

Nevertheless, the Twitter accounts of cryptocurrency projects, press releases on the official websites of companies, foreign sources like Bloomberg, Reuters, CNBC, etc. can also serve as irreplaceable assistants to the trader. The calendar of events of the crypto industry is also very useful.

Such a wave usually consists of four phases: the appearance of hearing. Growth on expectations is the appearance of confirming news, profit-taking, establishing an equilibrium price correction. At first glance, a paradoxical situation can be observed good news came out, and crypto-assets are rapidly falling in price. This means that information has already a large circle of people and all the cream is skimmed.

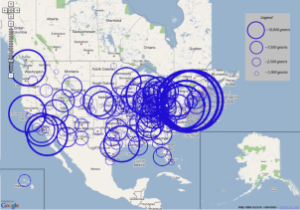

The main objective of the investor with this strategy is to manage to open a deal closer to the first point in order to maximize his profit at the end of the hype. It should be remembered that the strength of the trend is proportional to the number of recipients of hearing.